Negative or positive gearing, which is the best option?

Here we look at both sides of the gearing strategy, positive or negative.

Whether negative gearing is the best option for property investing depends on various factors, including your financial situation, investment goals, risk tolerance, and market conditions. Negative gearing occurs when the expenses associated with owning an investment property (such as mortgage interest, maintenance costs, and property management fees) exceed the rental income generated by that property. The shortfall can then be offset against other income for tax purposes, potentially reducing your overall tax liability.

Here are some considerations regarding negative/positive gearing:

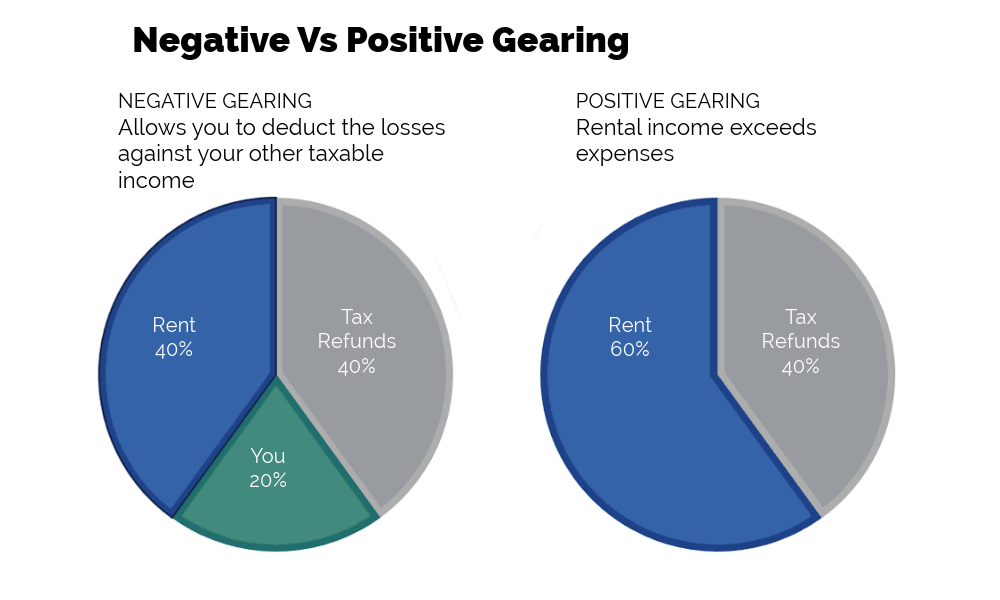

Negative gearing can provide tax benefits by allowing you to deduct the losses against your other taxable income. This can result in a lower tax bill, particularly for individuals in higher tax brackets.

Property values tend to appreciate over time, and negative gearing may be a viable strategy if you believe that the property's value will increase significantly in the future, offsetting the current losses.

Negative gearing could put pressure on your cash flow, as you'll need to cover the shortfall between rental income and expenses from other sources. This can be challenging, especially if interest rates rise or if the property remains vacant for an extended period.

Negative gearing may be more attractive in markets where rental yields are low compared to property prices, as it allows investors to offset some of the losses.

However, it's essential to consider whether the property market is expected to grow in the future to offset current losses.

Investing in property solely for negative gearing purposes carries risks. If property values decline or rental income decreases, the losses could outweigh the tax benefits, resulting in a negative overall return on investment.

There are alternative investment strategies, such as positive gearing (where rental income exceeds expenses), that may be more suitable depending on your investment objectives and risk tolerance.

Whether gearing is the best way to invest depends on your individual circumstances, financial goals, risk tolerance, and the specific investment opportunities available to you. Gearing can amplify both gains and losses, so it's crucial to carefully consider the following factors before deciding if gearing is the best approach for you:

Gearing involves, in most cases, borrowing money to invest, which increases the level of risk in your investment portfolio. If your investments perform well, gearing can magnify your returns, but if they perform poorly, losses could be substantial.

Consider your investment time frame, your age is important as gearing may be more suitable for long-term investments where you have time to ride out market fluctuations and benefit from compounding returns. Short-term investments may be too volatile for gearing and for those of later years.

Always evaluate the potential returns and risks of the investment opportunities available to you. Gearing may be more suitable for investments with strong growth potential that can outperform the cost of borrowing, at Capitl we can provide you with a clear and defined path to understand those risks.

It is also important to learn how gearing fits into your overall investment strategy and portfolio diversification. Diversifying your investments can help spread risk, but it's important not to over-leverage yourself by borrowing too much.

In Summary

In summary, gearing can be an effective way to amplify investment returns, but it's not without risks. It's essential to carefully assess your financial situation, risk tolerance, and investment objectives before deciding if gearing is the best approach for you. Additionally, seeking advice from Capitl can help you make informed decisions about whether gearing aligns with your investment goals.

Keep in mind investing can be easy to get into but can be extremely difficult to get out of, particularly in times of financial stress.

Understand the process with Capitl, we can show you what to avoid and certainly the benefits of investing.

Book an appointment with us here at Capitl to discuss further.